The Wisconsin rental agreements are used by landlords to enter into legally binding rental arrangements with a tenant. Whether the property in question is residential or commercial, or the landlord wishes to create a long-term or short-term tenancy arrangement, the list below contains all the rental forms required to establish a written lease agreement. In addition to rental contracts, this page contains forms that can be used before and during a tenancy. Before having a tenant sign a rental agreement, a landlord can download the rental application form and have all interested parties complete one to help them find the best tenant. A notice to quit form is available to notify a tenant that they are currently defaulting on their lease agreement. All forms are made in accordance with State laws (Commercial: Act 143 | Residential: Chapter 704) which determines how the agreement should be written and what responsibilities each party will have during the term of the tenancy.

Wisconsin Rental Lease Agreement Templates | PDF

Wisconsin Lease Agreements

The Wisconsin rental application is a document used to screen potential tenants to see if they are suitable for a residential lease agreement. This form, once downloaded by a landlord, can be presented to all individuals applying for a particular rental property. The applicants must enter their personal, employment, and financial information into the form. For more thorough examinations, the tenant may be asked to provide their previous year tax return to prove income. Any costs associated with the background…

The Wisconsin standard residential lease agreement is a contract used solidify the terms and conditions with regard to rented livable space. It is common for the landlord to take into account the tenant’s financial and employment status before issuing a lease; this can be accomplished through a background check and the completion of a rental application form. The landlord and tenant will look through the lease agreement together to make sure all the provisions are fair and reasonable. The most…

The Wisconsin notice to quit forms are used to notify a tenant that they have failed to pay rent on time and must either pay the amount owed or vacate the premises. In Wisconsin, the length of the tenancy will determine how much time the tenant is given to pay the rent they owe before the lease is terminated automatically. For leases over a year, the tenant has thirty (30) days from the date the notice is given to remedy…

The Wisconsin sublease agreement is a legal document used for the renting of space by a tenant (sublessor) and a person seeking rent all or a portion of that space from them (sublessee). A sublease can only be established if the sublessor gets permission from the landlord to do so. The sublessor, not the landlord, will be fully responsible for the sublessee. This means that the original tenant will continue to pay the amount due as per the original lease…

A Wisconsin commercial lease agreement is a document that binds a tenant, acting as a business entity or individual, and a property owner of retail, office, or industrial space. The landlord should always review the tenant’s credentials and may wish to verify that they are a legal entity with the Secretary of State Website. Tax returns for prior years should also be requested and, once the tenant is approved, the verbal negotiations should be transferred to a final written agreement….

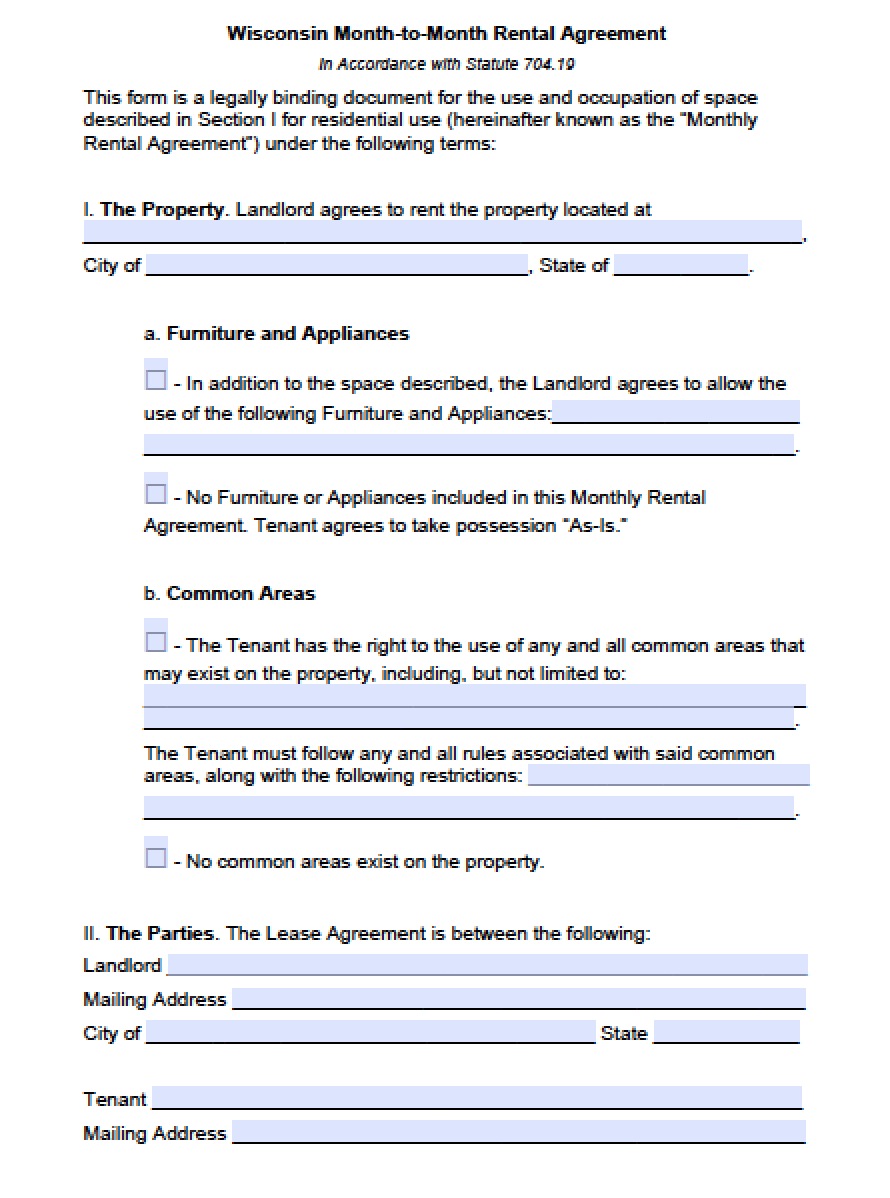

The Wisconsin month-to-month lease agreement is a rental contract that allows a tenant and landlord to establish a temporary arrangement with regard to the renting of residential property. Just as the title suggests, this type of rental agreement permits the tenant to pay rent in exchange for property access on a monthly basis. The contract may be terminated at any time by either party (as long as the legal notice period is used) which makes it a convenient arrangement for…

STATE DISCLOSURES

Housing Code Violations (ATCP § 134.04(2)) – Landlord must disclose to a prospective tenant any code violations and conditions affecting habitability.

Landlord/Manager Identity (ATCP § 134.04(1)) – Tenant must receive, in writing, the names and addresses of all persons authorized to manage the property, collect rent, and/or accept notices and demands on behalf of the owner.

List of Damages (ATCP § 134.06(1)(b)) – Should a tenant make the request, the landlord is required to provide them with a list of damages that were charged to the previous tenant's security deposit, regardless of whether the damages had been paid or not.

Check-in Sheet (§ 704.08) – A check-in form must be provided to all new tenants and should be completed by the tenant and returned to the landlord within seven (7) days. This Check-out Form may be used after the tenant has moved out.

Nonstandard Rental Provisions (134.09(2)(c)) – Document must be attached to the lease if the landlord wishes to enter the property for reasons not listed with the State.

Lead-Based Paint – Federal law requiring all landlords to inform tenants of the potential hard of lead-based paint in housing built prior to 1978.

SECURITY DEPOSITS

Maximum – Landlord may charge any amount they see fit as a security deposit.

Returning (§ 704.28) – The landlord must give back the deposit within twenty-one (21) days to the tenant after they have vacated the property.

LANDLORD'S ACCESS/ENTRY

Landlord may only access a tenant's property with proper reason and with twelve (12) hours notice (ATPC 134.09(2)(a)).