Arizona rental agreements are for landlords to create a legal contract with a tenant for the lease of commercial or residential space. Rent payments are made on a monthly basis, commonly on the 1st. If rent is late in Arizona, the tenant is required to pay rent at the time and place mentioned in the lease agreement (no grace period). If late, the landlord will issue a notice to quit giving five (5) days to pay in full.

Arizona Rental Lease Agreement Templates | PDF

Arizona Lease Agreements

An Arizona standard residential lease agreement is a document wherein a tenant agrees to lease out a property for a term of at least one (1) year. The form enables both parties to review the terms and conditions by which they must operate and, once signed, can be used as a point of reference that will hold both tenant and landlord accountable. Provisions such as the amount of rent, the due date for payment, the existence and application of late…

An Arizona month-to-month lease agreement contract has the tenant pay rent every (30) thirty days to the landlord, until either the tenant or landlord gives 30-day notice to terminate. The primary benefit of this type of lease agreement is it enables each party to operate with a degree of flexibility; often monthly tenancies are temporary and used when a tenant is planning on staying for a few months at a time. As a landlord, there are two (2) options to…

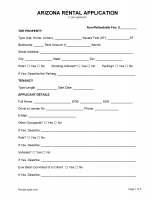

An Arizona rental application is used for the screening process of potential tenants to see if they are financially capable of paying the monthly payment. The landlord will be able to view the information and, if needed, obtain a credit report to see if there are any outstanding debts against the applicant. In addition to a background check, references may be required to verify that the previous rental experiences were positive for all parties involved as has all work experience….

An Arizona five (5) day notice to quit is sent to a tenant in the event they are late on rent. The notice gives the tenant five (5) days to either pay the back rent in full or vacate the premises. The balance may include interest or fees accrued due to the late payment of the owed rent. The form can be submitted via certified mail, regular first class mail, or it can be hand-delivered. When is it due? – Rent…

An Arizona commercial lease agreement enables the owner of property to lease it out to any willing occupant in need of retail, industrial, and office space. The commercial lease agreement differs from that of a residential lease in the fact that the landlord may not collect rent until the business of the tenant begins earning sufficient money to cover costs. The tenant will also have to gain the landlord’s permission before altering the property in any way. These are the…

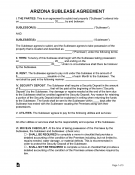

An Arizona sublease agreement form allows the current tenant of a property to share the rent with another individual, called the “sublessee.” In Arizona, subleasing is popular with college students and with those who want to reduce the sum of their monthly rent. However, take note that the sublessee does not directly pay the landlord. If the sublessee were to skip a payment, the original tenant, called the “sublessor” would be required to pay the landlord in full. It is…

DISCLOSURES

Non-Refundable Fees and Security Deposit(s) – Any and all deposits or non-refundable fees must be stated in the lease agreement in order for it to be legally acceptable (Statute 33-1321).

Move-in Checklist – The landlord must furnish the tenant with the move-in checklist prior to granting access so they are able to write any defects or repairs needed in order to protect their Security Deposit. The form is advised to be filled-in with the landlord present at the beginning and the end of the term (Statute 33-1321).

Pass-Through Tax – If at any time the local property taxes are increased, the landlord may pass the tax on to the tenant with at least thirty (30) days’ notice. This statement must be in the lease agreement for the lease to be valid (Statute 33-1314).

Providing Lease – Landlord must show the tenant where to find this document. (Statute 33-1322).

Residential Landlord and Tenant Act (Revised July 3, 2015)

SECURITY DEPOSITS

Maximum (§33-1321(A)) – One (1) and a half month’s rent.

Returning (§33-1321(D)) – Landlord must return the deposit within fourteen (14) days following the termination of the tenancy.

LANDLORD ACCESS/ENTRY

Landlord has the right to enter the property for any scheduled maintenance with at least two (2) days’ notice (§33-1343). Notice may be oral or written.